Foreign Tax Credit Benefit

A US taxpayer who is a tax resident of a foreign country where s/he is required to pay taxes may choose to use these taxes as a credit against their US expatriate tax return. These credits are usually claimed on US Federal Form 1116, Foreign Tax Credit which can be annexed to your US Federal Form 1040, Individual Income Tax Return. The Foreign Tax Credit and the Foreign Earned Income Exclusion are mutually exclusive in that only one of them can be used on any given year and the credit cannot exceed the foreign tax liability.

Background on the Credit

Moving to a new country may sometimes generate US expatriate tax liabilities on one´s foreign earned income. This can expose a US Expatriate to double taxation – in your new foreign host country and back home in the USA. One of the typical methods to mitigate this impasse is the Foreign Earned Income Exclusion which allows an exclusion as high as $101,300 for 2015 or $100,800 for 2016. The Foreign Tax Credit can also be taken although not on the same income. It is imperative to take advantage of the entire spectrum of these benefits to protect your income from double taxations.

Restrictions

Restrictions

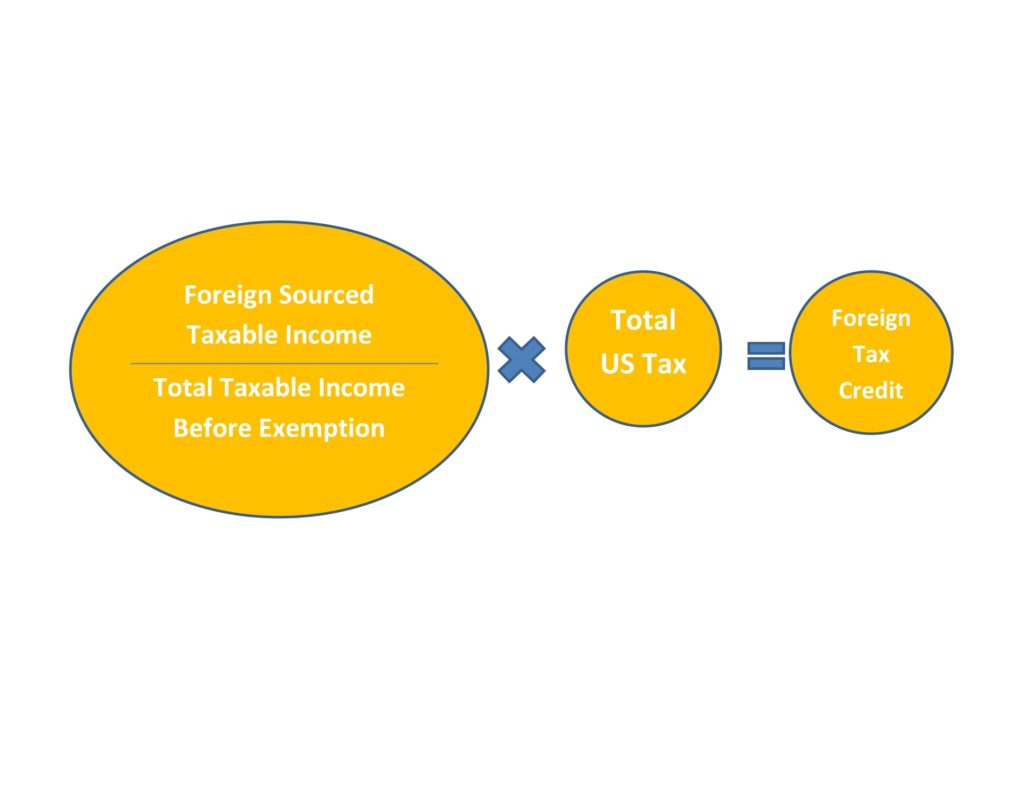

The Foreign Tax Credit taken on your US Expatriate tax return cannot surpass the US expat taxes paid on foreign income. The best formula to determine the amount of the limitation is the following:

Foreign Sourced Income (FSI) ought to include all income earned in a foreign country including interest from foreign banks, dividends from foreign corporations, rental from foreign property, foreign self-employment or employment. If the self-employment or employment income was earned both in the US and a foreign country, the income should be allocated based on days worked in the United States and days worked in the foreign country.

Taking the Foreign Tax Credit

There are 4 specific criteria to qualify a taxpayer to use Foreign Tax Credit on your US expatriate taxes:

- The tax must be assessed on income

- The tax liability must be either paid or incurred

- The tax liability is imposed on the US taxpayer

- The tax must have originated legally in a foreign country.

The greatest benefit of the Foreign Tax Credit is that a credit goes against the US expat tax dollar for dollar rather than being a deduction on income.

The Foreign Tax paid must be reported in US dollars after each transaction are converted at the spot foreign exchange rate (ie on the date of the transaction). Alternatively, an average foreign exchange rate can he used if there´s excessive transactions or the exchange rate is not readily available. Also, if the tax has yet to be paid or is accrued, then the year-end foreign exchange rate should be used.

Carrybacks and Carryforwards

It is common to pay excessive foreign tax relatively to US taxes and consequently have credit ¨in bank¨. These ¨in bank¨ credits can actually be accumulated and used in the tax year immediately preceding the current year OR for the next ten years. That is the concept of Carryback and Carry Forward.

Alternative Use for Foreign Tax

Foreign tax can be used as credit but also as a deduction. Typically, however, it is much preferable to use the credit method as it reduces tax liability dollar for dollar. Using the foreign tax a deduction has limited benefit as it reduces taxable income (not tax liability)

Let´s consider for example:

In 2016, taxpayer has foreign income at $100,000 and paid $45,000 in foreign taxes. The taxpayer would owe $37,000.

Under the credit method, there would be not a US tax liability because:

| Foreign Income | $100,000 | ||

| US tax @ 37% | $37,000 | ||

|

Foreign Tax Paid @ 45% |

$45,000 |

||

| Foreign Tax Credit Allowed (Lower of US Tax and Foreign Tax) |

$37,000 |

$37,000 | |

| US Tax Due (US Tax – Foreign Tax) | $ – | ||

| Unused Tax Credit Carryover (Foreign Tax Paid – Foreign Tax Credit Allowed) |

$8,000 |

Under the deduction method, there would be not tax liability because:

| Foreign Income | 100,000 | |||

| Foreign Tax Paid @ 45% | 45,000 | |||

| Net Taxable Income | 55,000 | |||

| US Tax @ 37% | 20,350 | |||

|

In summary |

||||

| Credit Method | Deduction Method | |||

| Foreign Tax | 45,000 | 45,000 | ||

| US Tax | – | 20,350 | ||

| Total | 45,000 | 65,350 | ||

Please make sure to contact us for any question you may have on the subject.

No comments yet.